The main reason you should track your expenses is to gauge your spending habits by identifying and eliminating the unnecessary spending patterns in your financial life. When you constantly track your expenses, you will have the power to control them, which is a wise move as you will adopt better financial habits of saving and investing. Here is how to do it like a pro!

- Categorize your Expenses

Creating a budget gives you a forecast on how much to save, spend, and invest. You can begin tracking your expenditures by categorizing them into various stacks. This will help you to:

• Know your current financial situation and align your budget with your long-term goals

• Have a general idea of your overall expenses

• Understand your spending patterns and choose on adopting proactive measures

• Track expenses and identify spending patterns

So, how do you classify your expenses? There are two approaches: fixed expenses and discretionary expenses.

Fixed Expenses

These are the basic expenses that you cannot do without. They include:

• Rent

• Food

• Education

• Transportation

• Insurance

• Home and utilities

Discretionary Expenses

These are expenses that are not basic, but they generally improve the quality of your lifestyle.

• Travel

• Food and dining

• Shopping and entertainment

• Memberships

Categorizing your expenses will keep you financially organized, maintain your financial goals, and help you keep an eye on your spending habits.

2. Plan on How to spend on these categories

Budgeting is ideally telling your money where to do instead of wondering where it went. A budget works hand in hand with good planning, and you need to know how much to allocate for each expense category.

Here are the 4 main categories:

a) Mandatory Bills & Expenses

Mandatory bills refer to the needs that you can’t do without. According to the 50-30—20 rule of thumb, you should ideally allocate 50% of your net salary to this. So, if you earn 50,000 then you should only spend 25,000 on that. The rest is allocated to the other three expenses.

b) Debt Repayments

If you have any debt at all, either good debt or bad debt, you must plan for and allocate money that should go towards repayment every month. These include

• Bank loans

• Mobile Loans

• SACCOs or other financial institution loans

• Personal loans

If you don’t have any debt, you can add the allocation to your savings and investments.

c) Savings and Investments

Savings refers to setting aside money for future use, either in the short-term or long-term while investing requires directing money to financial assets that will help grow and multiply your money. Both of these things must be allocated for and your progress tracked to ensure you are achieving your financial goals as and when you said you would. The trick here is to always ” PAY YOURSELF FIRST”, which means that you purposefully save and invest first, every month, before spending.

d) Entertainment, Giving and Miscellaneous Expenses

Do not be surprised when something pops up before the end of the month that requires you to spend money you had not planned to spend. That is normal. Many times, people ignore setting aside funds for miscellaneous purposes. For as long as we are social beings, birthday parties, bridal showers, wedding anniversaries and family reunions will always be here with us. Therefore, make it a mandatory to budget for these things. It creates flexibility on your budget and allows you to spend your money guilt free.

3. Have a record-keeping system that works for you

Now that you have categorized the expenses:

a) Use a spreadsheet

Excel is my favorite budgeting and tracking tool. Create a spreadsheet table with these expenses that should be updated regularly once you make any expenditure. You can use Google Sheets or Microsoft Excel to have the first template. Here is an already done-for-you budget tracking template in case you want to get it right the first time and save on time: https://thelegacyhub.co.ke/product/the-legacy-budget-tracking-template/

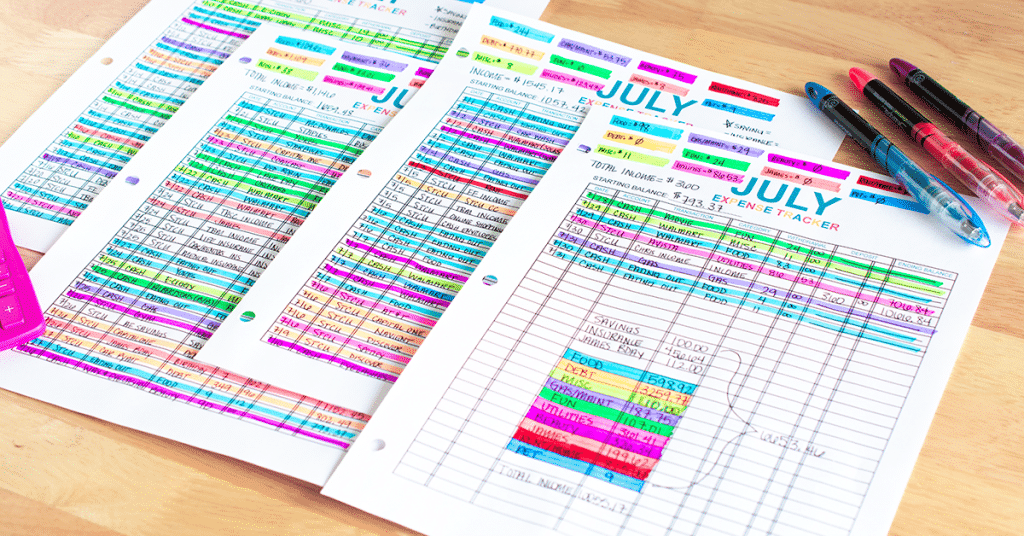

b) Use a notebook

Keeping your records through the notebook is also a perfect way of keeping your expenses on track. All you’ll have to do is put everything on paper to act as a reference for all your expenses Always note down everything you buy (however small).

c) Use Mobile Apps

Mobile Apps such as Money Manager, Mint, Pocket Expense, Spendee and many more are available on Playstore or Apple Store. It is advised that you do proper research on user friendliness and safety of your data before you chose to settle on one. they come a long way because, more often than not, you have your phone with you when incurring expenses. It can be a very effective way to keep tabs in real time.

You want to combine these three resources for effective tracking, because the records on your notebook and/or app should give you all the information to help you populate the excel sheet tracker more accurately, at the end of the month.

4. Review your expenses regularly

Ever heard the quote “out of sight, out of mind”? Yeahp! It applies to money too.

The less regularly you look at and adjust your spending habits and budget tracker, the less effective you will become at it. It is a rule of life that whatever you practice, you will improve at. It is important to have a routine that allows you to review your spending either weekly, monthly or whatever frequency works best for you. The most important thing is consistently reviewing. This helps you catch overspending early enough and fix the problem before it gets out of hand.

For easy reviewing of your spending, divide your expenses into fixed costs and flexible expenses then identify the expenses that change significantly every month. You can then gauge your monthly expenses and make a comparison with a three-month average of that entire period category.

This approach will reveal your spending habits. Have the discipline to stick to your budget and enjoy your way to attaining your personal financial goals.

5. Patience is key

Patience is one of the most underestimated and underutilized financial skill. It takes around 3-6 months to get used to tracking your expenses and coming up with a budget every month. It may take even longer for you to be able to stick to the budget that you set for yourself. One or two months are not enough, for you to decide that “this budgeting thing” simply does not work for you.

Simply learn from the mistakes you make every month (and trust me, you will fail many times) and start every new month with an intention and a plan to do better. Get accountability partners if you need to, automate savings & investments by putting standing orders with your bank if that’s what you must do or even get a personal finance coach to walk with you in those first few months. Get our personal finance coaching modules here: https://thelegacyhub.co.ke/personal-finance-coaching/