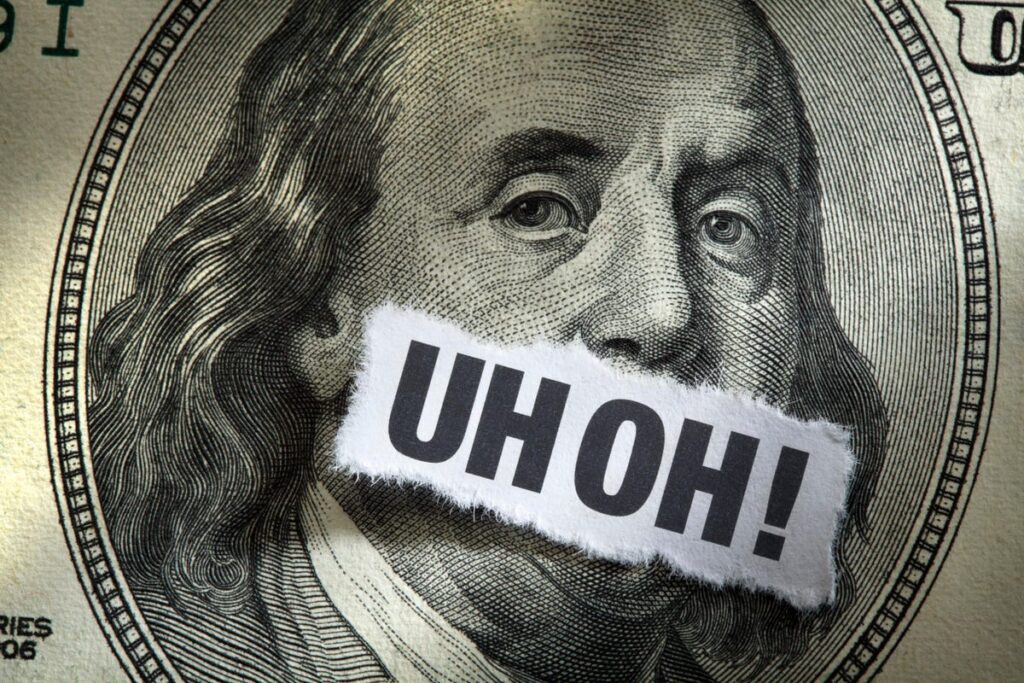

6 SIGNS YOU ARE HEADING TO FINANCIAL DISASTER

When some things happen to us, we are completely caught off guard. We genuinely did not see them coming. But other things happen to us because the red flags were there, all over the place, and we kept ignoring them or simply just missing them. In financial matters when we fail to acknowledge the signs, […]

HOW MUCH DO YOU NEED TO RETIRE?

A couple of weeks ago there was a Twitter conversation about a guy who had worked for 25 years, contributing to NSSF. After 25 years of contributing around KES 200 to NSSF, he was expecting less than a hundred thousand worth of pension savings. If that is not crazy to you. I really do not […]

THE 5 MOST ESSENTIAL BUDGETING CATEGORIES

Budgeting is the basis of all healthy personal finance habits. Get the budget categories right and you will be amazed how effortlessly you achieve your financial goals. A strong budget will assist you in preventing “spending leaks,” or spending money without thinking. It will assist you in ensuring that you have enough money to make […]

CUTTING COSTS VS MAKING MORE MONEY

Is the budget deficit most of us experience every month a result of an income problem or a spending problem? When you don’t have money do you prefer to cut costs or do you endeavor to increase your income? In today’s blog, we’ll explore which is the better option between the two. Cutting costs I […]

LIFESTYLE CREEP : THE WORST FINANCIAL MISTAKE

Remember the time, probably at the beginning of your career, when you were earning way lower than you do right now? Remember how you managed to get by with the little income you had. You were on a tight budget and so every coin had to count for something? Quick question: When your income increased, […]

HOW TO BUILD BETTER SAVING HABITS

Ever felt like, whenever you start saving for rainy days, it rains the next day? That is how trying to get into saving habits is. Just when you have set aside some cash, a need might arise and the cycle keeps happening, so you almost never have savings. But don’t worry, your savings habits might […]

SIGNS THAT IT IS TIME TO BREAK UP WITH YOUR BANK

Most Kenyans have at least one bank account, and the account has likely been with the same bank ever since they started banking. Rarely do people realize that the banking industry is a highly competitive one. Banks out there are trying to outdo each other by providing the best rates and incentive services to retain […]

TOP 5 PERSONAL FINANCE CHALLENGES AMONGST KENYANS

I remember a time when a loaf of bread was at a stable price of KES 50. A packet of milk too, and even cooking oil was moderately priced. As things stand at the moment, a packet of milk is KES 65, the egg prices are constantly fluctuating and still more taxes on flour -among […]

6 MONEY MISTAKES YOU SHOULDN’T MAKE THIS YEAR

Wealth is something you build. You build it through intentional spending, saving, and investing. You build it through healthy money habits. And you don’t have to be earning a certain amount to start building your wealth. It can be as simple as faithfully saving 1% of whatever you earn and later, when the savings become […]

7 INVESTMENTS YOU CAN MAKE WITH KES 5,000

Many of us hold the false notion that you have to be experts with a lot of money to start investing. We often promise ourselves: I will start investing when I reach a comfortable pay grade. Or, I still don’t know where to start and I may lose money. While these thoughts may sound rational […]

HOW TO BUILD YOUR FIRST EMERGENCY FUND

Having an Emergency Fund is a necessity! It is a shock absorber for the bumps of life that come every so often. Emergencies and unexpected expenses can strike when you least expect, and it’s for this reason that saving money in an emergency fund is essential for your finances. It’s time you start an emergency […]

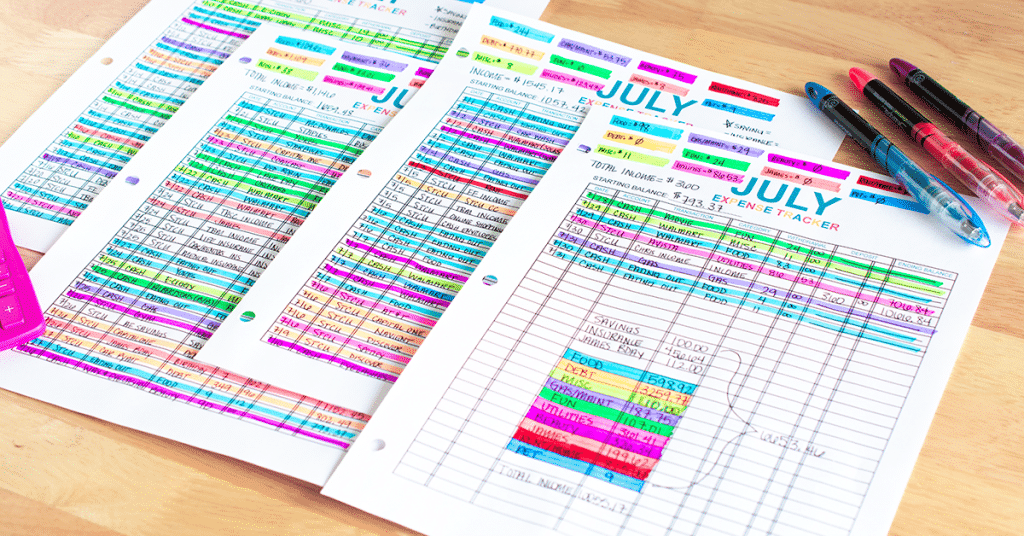

WHY EXPENSE TRACKING IS IMPORTANT AND HOW TO DO IT LIKE A PRO!

The main reason you should track your expenses is to gauge your spending habits by identifying and eliminating the unnecessary spending patterns in your financial life. When you constantly track your expenses, you will have the power to control them, which is a wise move as you will adopt better financial habits of saving and […]